Understanding Crypto Scams

Crypto scams refer to fraudulent schemes designed to manipulate individuals into investing their money into non-existent or worthless projects within the cryptocurrency ecosystem. These scams exploit the unregulated nature of digital assets, making it essential for investors to recognize the distinguishing features that separate legitimate investments from illegitimate ones. Various types of crypto scams have emerged, each employing unique tactics to deceive potential victims.

One prevalent form of crypto scams is the Ponzi scheme, wherein returns are paid to earlier investors using the capital of new investors, rather than from profit generated by the business. This structure creates the illusion of profitability and sustainability, but ultimately collapses when attracting new investments becomes increasingly difficult. Scammers often attempt to present their schemes as legitimate investment opportunities, leveraging the alluring promise of high returns with minimal risk.

Phishing attacks are another common tactic within the crypto landscape. These scams involve tricking individuals into revealing sensitive information, such as private keys or login credentials, through spoofed emails or fake websites. Victims may believe they are interacting with reputable platforms when, in fact, they are providing their data directly to fraudsters. Awareness of such deceptive practices is crucial to safeguarding one’s assets.

Additionally, fake Initial Coin Offerings (ICOs) have gained notoriety in the crypto space. Scammers create a polished façade, often including a professional-looking website and whitepaper, to entice unsuspecting investors into purchasing tokens that lack any real value or functionality. Recognizing the signs of a fake ICO, such as unrealistic promises or vague project details, can help individuals avoid significant financial losses.

The psychological tactics utilized by scammers further complicate the landscape. They leverage urgency, fear of missing out (FOMO), and social proof to coerce potential victims into making hasty decisions. Developing an understanding of these tactics is vital for anyone involved in the crypto market, as it enhances their ability to identify potential threats and make informed investment choices.

Common Types of Crypto Scams

As the cryptocurrency market continues to grow, various schemes targeting unsuspecting investors have emerged. Understanding the common types of crypto scams can significantly reduce the risks associated with cryptocurrency investments. Among the most prevalent scams are fake exchanges, giveaway scams, and pump-and-dump schemes.

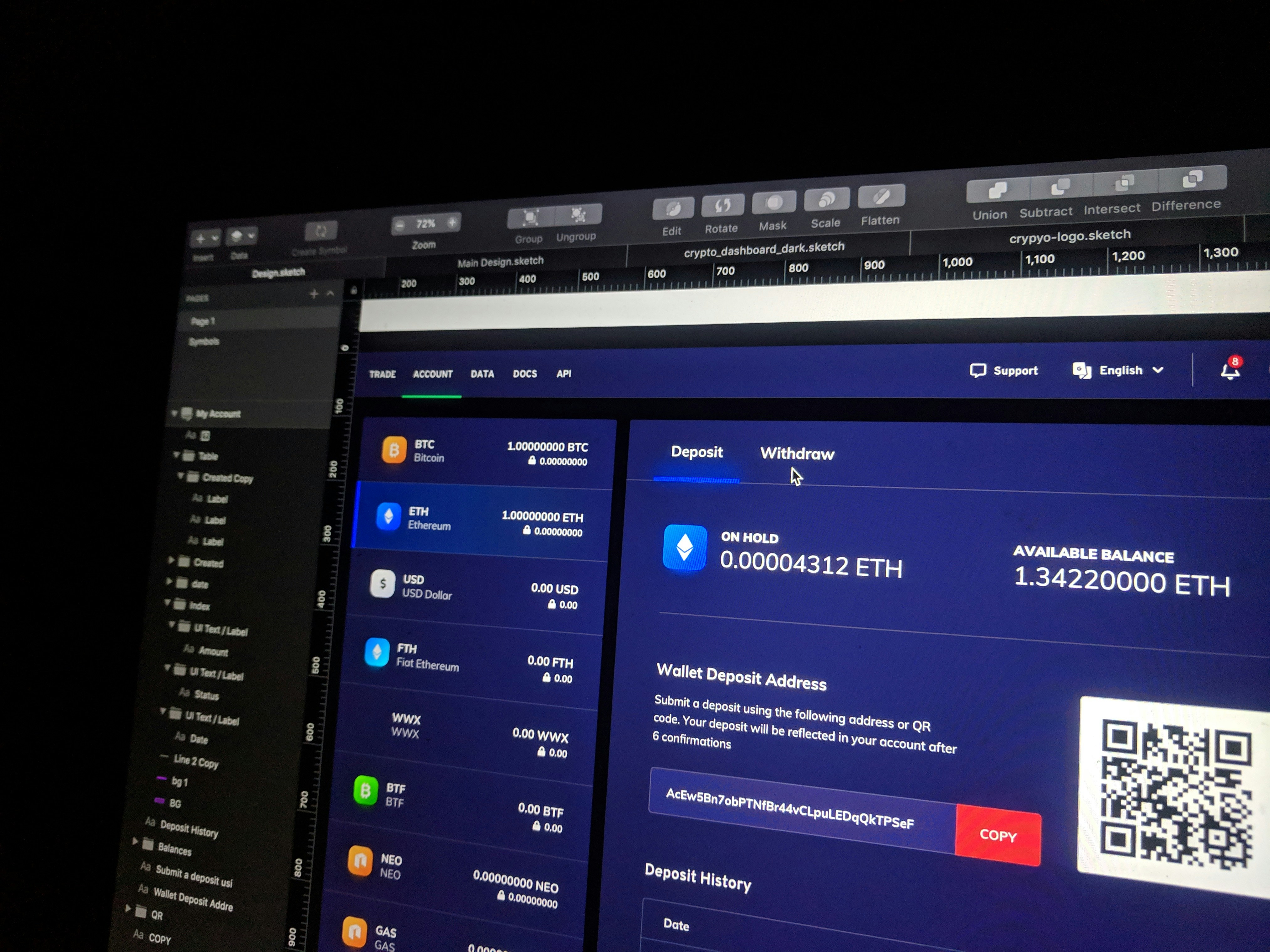

Fake exchanges frequently lure users into trading on fraudulent platforms. These scams often replicate the appearance of legitimate exchanges, featuring enticing transaction rates and promotional offers. Victims deposit their funds, only to discover that they have been swindled when they attempt to withdraw. A notable case occurred in 2020 when a prominent fake exchange claimed to offer cryptocurrency trading with inflated returns, leading to millions of dollars in losses for participants who trusted its facade.

Giveaway scams are another common form of deception. In these schemes, scammers promise large returns on investments or offer free cryptocurrency in exchange for a smaller amount sent to them. Often, these scams utilize social media channels, where they impersonate well-known figures in the crypto space. A famous example is the Bitcoin giveaway scam involving prominent Twitter accounts, which resulted in numerous individuals being coerced into sending funds with no possibility of receiving any returns.

Lastly, pump-and-dump schemes entail artificially inflating the price of a cryptocurrency through misleading promotion, creating a false sense of demand. Once the price escalates, orchestrators sell off their holdings at a substantial profit, while unsuspecting investors left holding the asset face significant losses as the price plummets. Such schemes have been reported multiple times within the market and serve as a reminder of the importance of due diligence.

Recognizing these common types of crypto scams equips investors with the knowledge needed to navigate the cryptocurrency landscape more securely. By remaining vigilant and informed about these deceptive practices, individuals can protect their funds and contribute to a healthier market.

Red Flags to Watch Out For

As cryptocurrency continues to gain traction, so does the potential for scams. Identifying the warning signs of a crypto scam is crucial for safeguarding investments and ensuring a secure experience in the digital currency market. One of the most glaring red flags is the promise of unrealistic high returns with minimal risk. If an investment opportunity seems too good to be true, it often is. Scammers often bait investors by guaranteeing specific returns within a short time frame, which is a tactic to lure individuals into a trap.

Another warning sign involves aggressive pressure tactics employed by solicitors. If an individual or company urges you to invest quickly, it is essential to take a step back and analyze the situation. Scammers often create a false sense of urgency, suggesting that the opportunity will disappear if you don’t make a decision right away. This tactic is designed to minimize the amount of time a potential investor might normally take to perform due diligence, leaving them vulnerable to a potential crypto scam.

Lack of transparency is also a significant indicator of dubious activity. If a platform or operation does not openly disclose crucial information about their team, business model, or security measures, it should raise a red flag. Legitimate cryptocurrency projects typically provide clear details about their operations, team members, and their approach to risk management. Additionally, be wary of poorly designed websites or inconsistent information, as these can also signify a fraudulent scheme. Investing time in thorough research prior to engaging in any cryptocurrency transactions is crucial to avoiding pitfalls. Remain skeptical of unsolicited offers and claims, and approach any investment opportunity with a discerning eye.

Best Practices to Avoid Crypto Scams

As the popularity of cryptocurrencies continues to grow, so does the prevalence of crypto scams. To protect oneself from falling victim to these fraudulent schemes, it is essential to adopt effective best practices. One of the fundamental steps to safeguard your digital assets is by using strong, unique passwords for all your accounts. This means incorporating a mix of letters, numbers, and special characters, and avoiding easily guessable information, such as birthdays or common names.

Another critical layer of security involves enabling two-factor authentication (2FA). By requiring an additional verification step—such as a code sent to your mobile device—2FA can significantly enhance the security of your accounts. It is a relatively simple measure that can deter unauthorized access and provide peace of mind.

When engaging with cryptocurrency platforms, it is vital to refrain from sharing personal information unnecessarily. Scammers often pose as legitimate officials asking for sensitive data or access to your accounts. Always verify the credibility of individuals or organizations requesting such information by approaching inquiries with skepticism.

Researching the legitimacy of crypto projects, exchanges, and investment opportunities is imperative. Before investing, take the time to read community reviews, join online forums, and consult educational resources to gauge public opinion about a specific project. This research can help identify potential red flags and ascertain whether a platform is reputable.

Finally, engaging with well-established platforms can lessen the risk of encountering crypto scams. Look for exchanges that have a history of transparency, solid security measures, and positive customer feedback. The informed decisions that arise from proper due diligence can drastically reduce the likelihood of falling prey to scams in the crypto space.